January 10th: Yesterday Emmanuel Mukwaya and I (Tom Sullivan) visited the Jinja Karoli Lwanga parish branch of the Wekembe project. Loosely translated, Wekembe means “We struggle together for the future”. It’s a microfinance association, founded by the Catholic Church in Uganda, which currently has 42 branches, 9 in Kampala and 33 in rural areas outside the city. We met with the association there, and heard some success stories from some of the women who have gotten loans. My favorite was Mrs. Proscovia Tibitha, who started her story by telling about her failed chicken business. Because of space limitations, she had tried to raise chickens in the garage, and the business tanked (I’m not sure what the Ugandan word for “tanked” is, but that’s how it was translated for me). Because of the business failure she no longer had money to pay school fees for her children, so they could not longer attend school. She joined the Wekembe association – the village bank - and after establishing herself by repaying a small loan, she got a larger loan to buy chickens and build a sort of chicken coop to house them. This enabled her to achieve some economies of scale, such as buying enough chickens to ensure that a reasonable number survived (apparently a number of chickens in each brood die), and she could also afford real chicken food, rather than scraping together whatever food was available. This led to healthier chickens, which in turn increased her income enough so that her children are now back in school, with fees paid. When we asked whether she was tempted to use the loan money to pay the school fees, we learned that the success of Wekembe depends heavily on the group – in this case, about 20 women – who are responsible for each other’s loans (and, at least indirectly, for each other’s success). The large group is divided into smaller units, which are responsible for paying any missed payment by a member of the group; the larger group must repay the loan of anyone who defaults. This “peer pressure”, along with the support and encouragement of the group members for each other, helps keep Wekembe profitable (it is currently self-sustaining), and it has enabled something like one thousand women in the Kampala area to start businesses and empower themselves economically. Two other interesting notes: (1) the Wekembe project only accepts applications from the “active" poor. This is a new term to me, but I gather it means those poor women who are already doing something to work for themselves (running a small subsistence business, or something along those lines). And (2) accepted applicants, besides agreeing to a biweekly schedule for repaying loan and interest, must also establish a “forced” savings account, so that some of the money they make from the business is put into savings twice a month. All in all, an interesting day’s trip (we are consulting with them to see what a Babson team might do to help them in the future; certainly a new accounting system might be in order)!

Today, the tenth, we visited Modudu to meet with an association of peanut (groundnut) growers; we're trying to hook them up with a new sheller that will cut their work time (for shelling) by about 90%, help them make more money, and get the shells ready for sale as fuel (now they just burn them). Anyway, it was very useful, and when I suggested to the students that we might just buy the association one (for $70) as a thank you, they found someone to donate it for free on the car ride home (these BGOE students can be very enterprising)! Anyway, a lot of driving, but a useful meeting, and a good result. And we learned a ton about the groundnut business from the point of view of the growers, including some valuable pricing information; for example, they can sell a bag of unshelled nuts for about $15, while a bag of shelled nuts - which takes four unshelled bags to produce - sells for about $70. Hello to all from here!

Tom Sullivan

UGANDA 2007

Kampala & Mityana

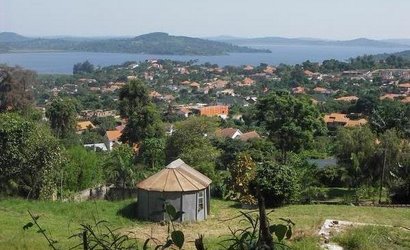

Ugandan Countryside

a view of Lake Victoria

Wednesday, January 10, 2007

Subscribe to:

Post Comments (Atom)

1 comment:

Tom,

It sounds like a really interesting microfinance business (especially the peer pressure mechanism) and the story is a great one to tell especially since she overcame a failure on the first try. I know that you are learning about the local businesses, but please tell us some stories about the projects themselves. I hope that everyone is finding the trip valuable, learning a lot from the experience and helping the locals with their businesses.

Michael Pearlmutter

Post a Comment